8 min read

Uncover Hidden Threats: The Essential Role of Adverse Media Monitoring in Compliance

Adverse media screening (also known as media monitoring or negative news screening) is a crucial part of customer due diligence (CDD). These checks help companies verify customers’ identities and assess their risk profiles. CDD is a regulatory requirement for companies entering into business relationships with a customer and is a big part of anti-money laundering (AML) and know your customer (KYC) directives.

Regulatory guidance states that businesses should take appropriate steps to identify and assess the money laundering and terrorist financing risks of their customers.

As part of the customer onboarding process, organizations should perform a set of checks to identify potential financial and corporate crime risks. There are levels of due diligence that can be performed as part of a Risk-Based Approach: this might include Simplified Due Diligence (SDD), Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD).

There is valuable motivation for performing Adverse Media Monitoring as it is instrumental in:

- Identification and evaluation of potential risks before they may escalate

- Enhanced due diligence in customer and partner relationships.

- Improved compliance with regulatory requirements and avoidance of fines.

Companies realize the necessity to continuously screen customers against news relating to financial crime or reputational risk, as well as sanctions and PEPs data, ideally in multiple languages. Many businesses look to automate this process in order to reduce human error, and international regulators even advocate for the use of automated ongoing monitoring.

During an onboarding process a business will likely perform the necessary checks on the potential business partner and their background.

Delivery of TPRM services, Monitoring Supply chain threats

USE CASE 1: Enhancing Third-Party Risk Management Through Advanced Filtering

In today’s global business world, accurate Adverse media monitoring is used for effective risk management across many sectors, such as Supply chain management, ESG, manufacturing and pharmaceutical industry. Key challenges in providing a reliable AMM involve reducing data noise, figuring out the complexity of filtering and minimizing the need for labor-intensive manual analysis.

Semantic Vision has been delivering AMM services to its UK client, employing its advanced systems for collecting and filtering data that ensure 95% recall while minimizing false positives results.

The whole process gets streamlined and our advanced technology minimizes manual workload, significantly reducing costs

Thanks to the SV technology that achieves the right balance between recall and false positives, almost no relevant events are missed due to enhanced filtering. By resolving the issue of unrestrictive filtering that leads to a high volume of irrelevant supplied data on customer’s end, the whole process gets streamlined, still furnishing valuable inputs for manual analytical reports. This advanced technology reduces manual workload for the client’s analytical team and thus represents significant cost saving.

The accurate adverse media monitoring and efficient risk management is possible through the high-quality data delivered by Semantic Visions.

Efficient filtering is essential for robust adverse media monitoring in third-party risk management. A partnership like the one between SV and its UK client is a demonstration of the importance of leveraging advanced filtering solutions to enhance risk mitigation strategies, enhanced business resilience and agility in the face of evolving risks that may have significant business impact.

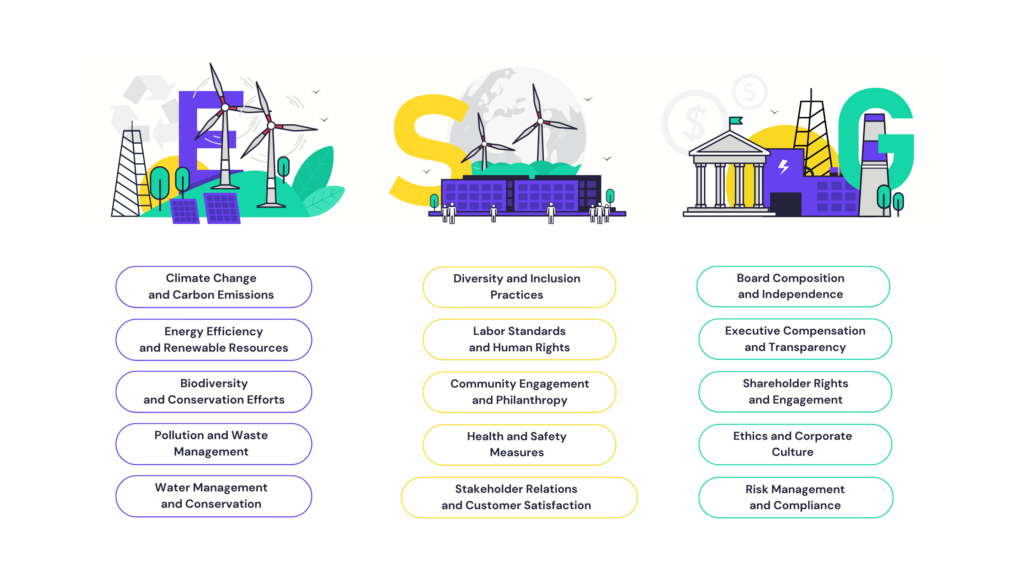

USE CASE 2: Leveraging ESG Compliance through Advanced Analytics

Another instance of applying Adverse Media Monitoring is the ESG agenda that is legislated in the EU as a Corporate Sustainability Reporting Directive (CSRD), in force since 2023. The act stipulates the rules for large and listed companies to publish regular reports on the social and environmental risks they face, and on how their activities impact people and the environment. The businesses are required to report according to European Sustainability Reporting Standards (ESRS).

Semantic Visions’ has developed its own automated tool to serve businesses in the area of ESG compliance. Its ESG Index reflects media perceptions regarding companies’ sustainability efforts, enabling proactive mitigation measures to safeguard business’ reputation and financial performance.

Semantic Visions ESG Index adds a layer of validity by offering historical screening and realtime, relevant information

In response to the market developments, Semantic Visions has embarked on a proactive approach. SV has created its own ESG Index, aimed at contributing positively to the ongoing dialogue within different industries. By leveraging and monitoring over 220,000 distinct domains in 12 different languages, our scoring system provides a representation of the media perception regarding a company’s sustainability efforts. This approach not only highlights areas of excellence but also identifies areas for potential improvement.

Besides providing insights derived from media perceptions, the index moreover adds a layer of validity to ESG assessments by offering both historical screening (up to five years back in time) and near realtime, relevant information.

Moreover, unlike other indexes primarily reliant on ESG data provided by companies themselves or by third-party entities, our Semantic Visions’ ESG Index offers a unique perspective: it reflects media perceptions regarding a company’s sustainability efforts. This enables proactive mitigation measures to safeguard your reputation and financial performance.

Drawing exclusively from published news articles, the Semantic Visions ESG Index score encapsulates the collective perception of a company’s ESG initiatives by the global community and the general public.

Furthermore, SV index with traditional due diligence enhances insights into suppliers’ reputations and behaviors, facilitating assessments of alignment between their ESG practices and sustainability goals. Distinguishing ourselves from the competition, we commit to a methodology characterized by complete transparency. SV ESG index formulates and presents straightforward equations to facilitate our customers’ easy comprehension of the materials provided.

By integrating ESG index, companies not only ensure compliance with global sustainability standards but also significantly reduce their risk of supply chain disruptions caused by environmental disasters or labor disputes.

By utilizing a proportional scoring system that SV ESG index embraces, we are able to offer precise assessments of companies across four distinct levels of ESG score detail.

Additionally to ESG scoring, a customer may also be interested in analyzing long-term trends. For instance, by monitoring in near real-time, dips in long-term trends can be detected, allowing for the business to take proactive measures before significant damage occurs (e.g., protect the company brand).

Finally, thanks to our capability to break down data into specific categories, our index can be a helpful tool for a company’s double materiality, which is the first step in mandatory EU CSRD reporting.

Semantic Visions’ ESG index delivers:

- Real-time, comprehensive Data Points

- Detailed Categorization and Subcategorization of ESG areas

- Insights into Public Perception

- Comprehensive Coverage

- Filtered Visibility

- Diversity of Sources

- Public Transparency

- Adaptability to Emerging Events

Leveraging advanced analytics, Semantic Visions explores hundreds of ESG events, providing a comprehensive view of challenges and impacts.

Understanding these events is crucial for stakeholders, offering insights into potential risks of non-compliance with ESG standards.

USE CASE 3: Business and Human Rights Compliance

Another example of an impactful AMM application is the Semantic Vision’s technology in the monitoring of business activities that must comply with various rules and standards, for instance regulations enacted to uphold human rights standards. SV set up monitoring in regard with the US federal law The Uyghur Forced Labor Prevention Act (2021) whose goal is to ensure that US entities do not fund forced labor among ethnic minorities in the Xinjiang Uyghur Autonomous Region.

Automated and in-depth data monitoring is critical to stay abreast of market development and potential negative events

Our AMM system can identify and evaluate any event that may signal a risk of breaching the restrictions stipulated by this US act. This is achieved through the interconnected network of many categories and events SV has created with respect to the legislation. This complex lexical web, meticulously crafted to align with our clients’ specific needs, enables automated monitoring of all major events relative to business operations in the province and to alert the client of any contravention of the said regulation: anything relating to operations based in Xinjiang, appointments, manufacturing facilities, imports, supply chain and distribution, as well as bidding for contracts, partnerships or project updates.

A SV client can profit from our data feeds that provide just the valuable information relative to the specific focus of the monitoring. Our automated and in-depth data monitoring is critical for our clients so that they can stay abreast of market development, potential negative events; moreover it reports incidents that could impact their operations or reputation, avoiding potential legal consequences.

Semantic Visions’s expertise

Semantic Visions has developed a coherent and comprehensive tool to identify and monitor multiple areas of business operations: financial risks, geopolitical threats, ESG compliance and performance, cyber security area and many others.

Semantic Visions technologies gather and process about 1m articles on a daily basis from 237 thousand domains. Semantic Visions covers all major global news, with the special advantage of operating in 12 different languages thus reaching the news before it hits the global audience.

Semantic Visions’ proven market expertise, coupled with its vast repository of historical data, enables effective performance screening, trend identification and monitoring, as well as comprehensive comparison and statistical analysis across various industries and businesses.

SV industry-specific categories cover all aspects of business operations, through the comprehensive web of semantic categories and scenarios encompassing most of human entrepreneurial activities.

Semantic Visions automated Adverse media monitoring service enhances customer teams by streamlining highly skilled and decision-centric work in operations such as anti-money laundering, sanctions screening alert review, and know your customer; customer service and onboarding; transaction monitoring; and other data-intensive compliance activities.