6 min read

The Importance of ESG Insights in Supply Chain Success

Over the past few years, ESG (Environmental, Social, and Governance) has become a key focus for companies, driven by growing regulations and evolving demands from banks and customers. Companies are now looking to assess their ESG performance not only in comparison to competitors but also across their entire supply chain. At Semantic Visions (SV), we have identified that the data we collect from global media can be instrumental in this effort. Our data can either stand alone as the SV ESG Index (detailed below) or enhance more complex ESG assessments, which typically rely on comprehensive data sources such as company questionnaires or annual non-financial reports.

With our own ESG Index and data from long-term monitoring, we have undertaken an in-depth analysis of how this index has evolved over time. Our analysis not only tracks changes in the index but also explores broader topics consistently associated with ESG. To support this work, we’ve assembled an extensive dataset covering the last four years, enabling us to identify and understand key trends and dynamics in the ESG landscape.

Given the heightened focus on ESG, we initially expected to see a significant increase in SV ESG Index scores across industries. However, our analysis has revealed a stagnation in performance, with many industries and companies not showing the anticipated improvements. This suggests that there may be underlying challenges or gaps in ESG strategies and implementations that need to be addressed.

Oil & Gas and Automotive Sectors: Leading Underperformers in ESG Compliance

Our data clearly shows that Oil & Gas, Automotive & Auto Parts sectors are among the worst performers, consistently lagging behind other industries. This underperformance is likely tied to the significant environmental impacts of their operations and the regulatory challenges they face.

TOP ESG Social Risks in Supply Chain: Workplace Incidents and Ethical Violations

A closer look at ESG-related news over the years reveals that the most frequent negative articles are related to workplace incidents, which fall under the Social Factors category of ESG. These incidents often involve issues touching topics such as worker safety, labor practices, and human rights. Additionally, companies in various sectors have been linked to illegal practices, including the production or trade of natural resources from conflict zones that fuel wars, exploitation of child labor, and unfair treatment of employees based on factors such as background, ethnicity, race, or sexual orientation.

Top ESG Events in Supply Chain: Leading the Way in Sustainability and Ethical Practices

On the other hand, companies with the highest long-term SV ESG Index scores excel in sustainable business practices, ethical supply chain management, and best practices for emissions reduction. These companies typically have a lower negative impact on the environment, community, society, and economy while maintaining progressive environmental and human rights policies. The data also shows that their supply chains and logistics networks are ethically based and sustainable, minimizing environmental impacts. Furthermore, they have made significant efforts to reduce carbon dioxide and greenhouse gas emissions associated with their operations.

The Critical Role of ESG in Supply Chains Amidst Emerging U.S. and EU Regulations

This is particularly important for supply chain companies to consider, especially with the upcoming EU supply chain due diligence regulations (EU CSDDD). In the U.S., similar pressures are mounting with the SEC’s proposed climate disclosure rules, which will require companies to disclose ESG-related risks and opportunities. The California Consumer Privacy Act (CCPA) and potential federal ESG reporting standards are also key factors. If your company has unresolved ESG issues, it could hinder your competitiveness as a supplier. It will have impact on financing options as well as attractiveness as a company for young generations of employees. As sustainable and socially responsible companies gain market value, strong ESG performance, especially in environmental practices, will be crucial for long-term success.

Leveraging and monitoring a significant part of global news media (i.e., more than 1.8 million news articles daily, covering 12 different languages), SV ESG Index scoring system stands out. Unlike other ESG indexes, which are primarily reliant on data provided by companies themselves, our index offers a unique perspective: it captures media perceptions of a company’s sustainability and social responsibility efforts by providing near real-time monitoring (hourly, daily updates), as well as historical screening (up to 10 years back in time).

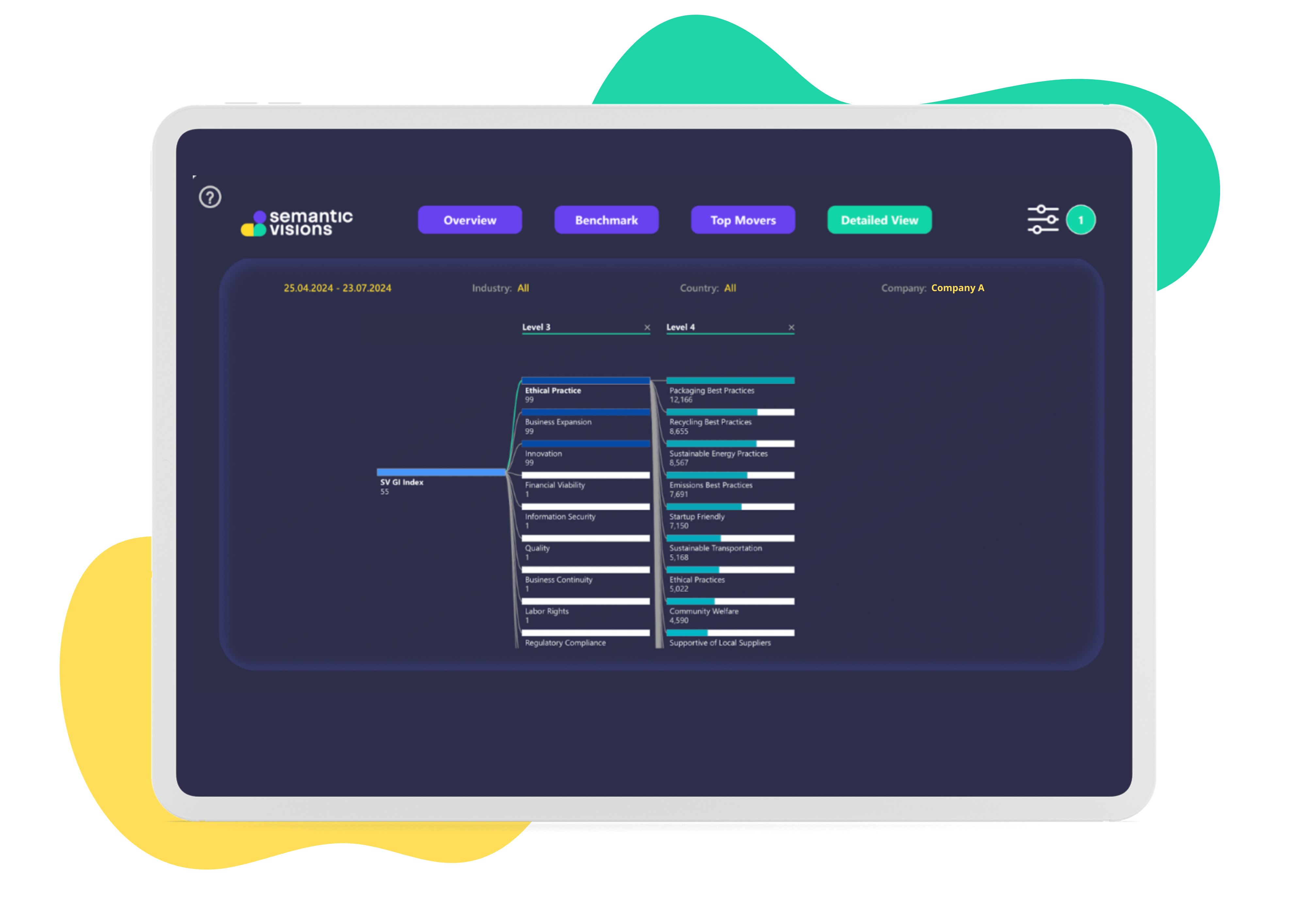

The SV ESG Index provides a detailed breakdown into four different levels (i.e., from overall score to specific events), each with its own rating, enabling clients to precisely identify specific strengths and weaknesses within the company, its supply chain, or across the industry as a whole. This comprehensive assessment empowers companies to gauge how their ESG performance is rated, facilitating informed decision-making and targeted improvements.

Businesses can derive substantial advantages from ESG topics monitored by Semantic Visions for several reasons. These encompass benchmarking and performance evaluation vis-à-vis industry peers, identifying and mitigating risks potentially affecting operations and reputation, recognizing opportunities for enhancement and value generation, monitoring supplier performance to ensure alignment with sustainability objectives, staying abreast of regulatory mandates to uphold compliance and mitigate legal and reputational risks, or to enrich datasets for ESG reports.

The SV ESG datasets can be delivered in two ways: as processed datasets for companies to integrate into their own calculations, models, or early warning dashboards. Alternatively, SV can provide tailored pre-configured SV ESG dashboards.

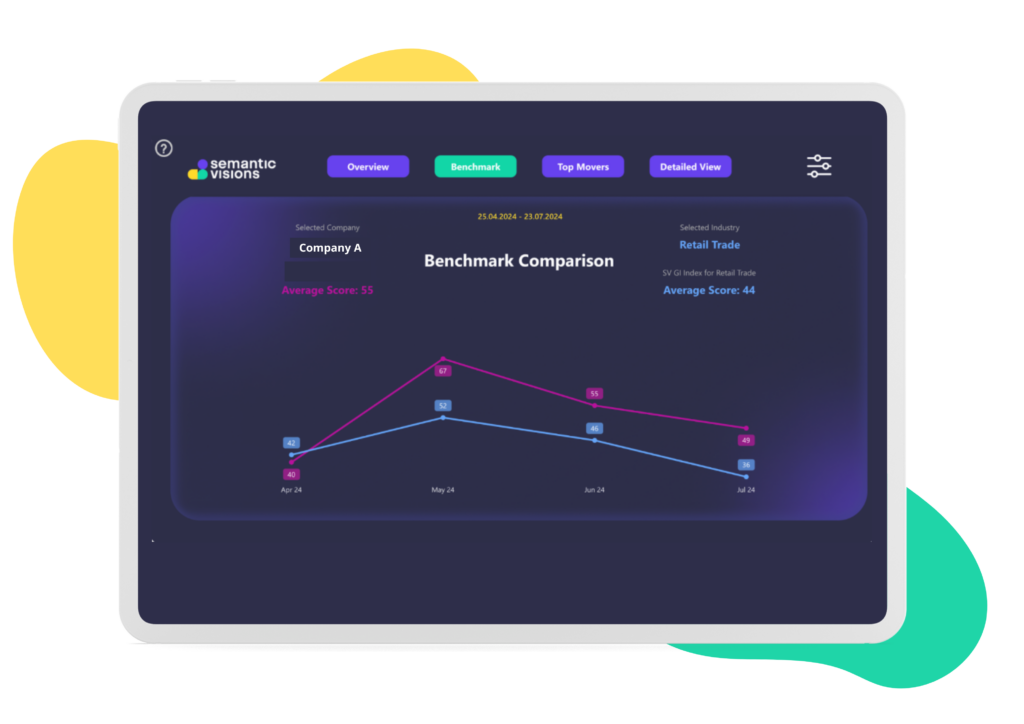

The SV ESG dashboards offer several key features:

- Overview Page: This page provides a long-term trend analysis for the ESG and Global Impact indexes. You can also switch views to monitor trends in both beneficial and adverse events. Additionally, you can drill down to specific dates to see detailed counts and specific events that occurred during a selected time period.

- Benchmark Page: This page allows for comparisons between companies or trends within individual industries, helping you understand relative performance.

- Top Movers Tab: Here, you can identify companies that have made the most significant positive or negative changes in the ESG or Global Impact indexes on a month-over-month basis.

- Detailed Breakdown: The final tab offers a comprehensive breakdown of all categories and subcategories within the ESG and Global Impact scores, providing deeper insights into specific areas of interest.

About The Author

Lukas Gabor is a passionate data scientist and ESG expert with a strong academic background and a growing career in the private sector. He specializes in developing comprehensive end-to-end ESG solutions for clients, ranging from initial assessments and data management to sustainability reporting and long-term goal setting. His experience includes working as a Senior AI & Data Consultant, where he leveraged advanced technologies to drive business innovation and strategic decision-making. Before transitioning to the private sector, Lukas was a Postdoctoral Research Fellow and Fulbright Scholar at Yale University, where he researched biodiversity patterns and processes. Lukas holds a Ph.D. and has a deep-seated interest in consulting roles related to ESG, data analytics, and UX research.