10 min read

M&A Strategy, Current State and What the Future Holds

M&A is a strategy for rapid growth, competitive advantage, and operational efficiency adopted by organizations and used to deliver shareholder value to create synergies, diversify, deliver tax benefits, and eliminate competition.

Below are the key characteristics that define the M&A market:

- Cyclical Nature (economic expansion vs economic downturns)

- Industry Specificity (certain sectors experience higher deal activity due to rapid innovation, regulatory changes, market competition, consumer preferences, etc.)

- Globalization (seeking cross-border opportunities, challenges of cultural differences, regulatory issues and political risks)

- Strategic Drivers (market expansion, synergies creation, value creation, etc.)

- Regulatory Environment (regulatory oversight, competition regulators, govt agencies)

- Technology and Innovation (tech companies, digital transformation, disruptive technologies, etc.)

- Shareholder Activism and Corporate Governance (shareholder engagement, transparency and accountability)

Below are the key risks that have affected the M&A market over the past year, as analyzed by Semantic Visions:

- Regulatory compliance issues

- Outer factors such as Pandemic

- Negative Reputational risks

- Corporate lawsuits

- Investigation

- Deteriorating financial situation

- Anticompetitive behavior

- Supplier problems

- Failure or shutdown

- Discontinuity or Divestment

The state of mergers and acquisitions (M&A) as of mid-2024 is showing signs of a recovery after a challenging period characterized by several key factors.

Recovery and Growth

After experiencing one of the worst bear markets for M&A in over a decade, the sector is starting to rebound. Improved financial markets, decelerating inflation, and anticipated interest rate reductions are contributing to a more favorable environment for dealmaking. Although the pace of recovery remains uncertain, there is optimism amongst key experts that M&A activity will steadily increase throughout 2024.

Industry Variations

Certain industries or sectors are leading this most recent M&A recovery. Sectors such as energy, technology, and pharmaceuticals are particularly active, driven by strategic needs such as the energy transition, technological advancements, and the pursuit of new drug pipelines. Conversely, sectors like banking and healthcare are seeing slower recoveries, with challenges such as high financing costs and operational difficulties impacting dealmaking.

Deal Types and Trends

While mid-market deals have remained resilient, the number of megadeals (transactions exceeding $5 billion) significantly declined but is now starting to pick up again. Notable recent megadeals include Hewlett Packard Enterprise’s $14 billion acquisition of Juniper Networks and Blackrock’s $12.5 billion acquisition of Global Infrastructure Partners.

Strategic Focus

Successful investors and dealmakers are expected to prioritize strategic value creation, adapt quickly to changing conditions, and focus on transformative deals. This includes leveraging technological disruptions, addressing sustainability challenges, and adapting to demographic shifts.

Despite the positive outlook, challenges such as higher financing costs and regulatory scrutiny remain. Companies that can creatively navigate these hurdles and strategically position themselves for growth will likely lead the M&A resurgence.

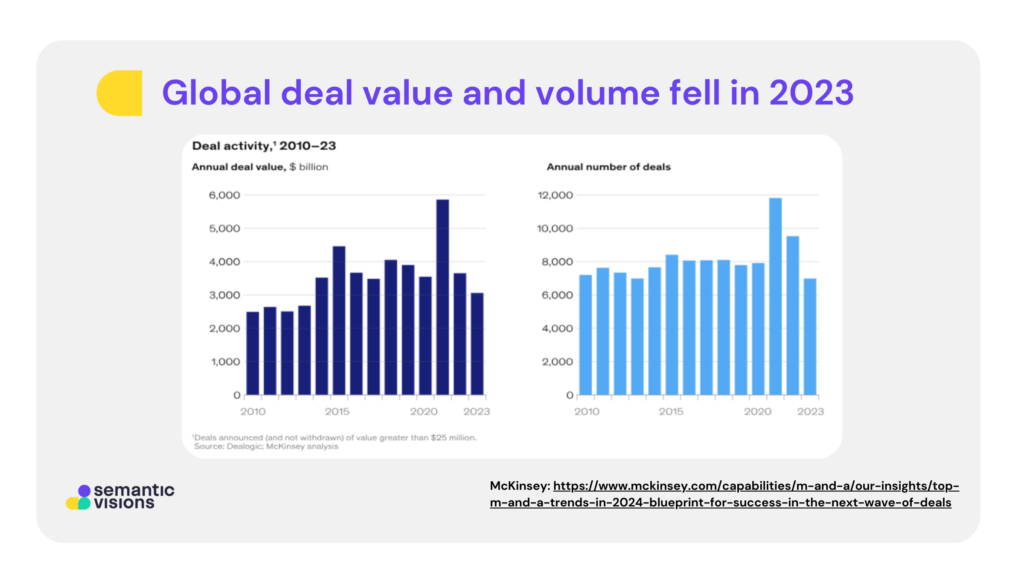

As noted above, the global M&A market has experienced fluctuations in deal activity and deal value. As of 2023, the global M&A market was valued at approximately $3.1 trillion, a decline from previous years, making 2023 one of the weakest years for M&A activity in the past decade. Several factors contributed to this downturn, including macroeconomic uncertainties, geopolitical tensions, and regulatory pressures.

Despite the challenges, there were some positive signs towards the end of 2023. The second half of the year saw a 30% increase in deal volume compared to the first half, with the fourth quarter being the most active. This uptick in activity has generated optimism for a potential recovery in 2024.

The M&A market is highly dynamic and influenced by a complex interplay of economic, regulatory, market-specific, strategic, and financial factors. Companies and investors must continuously monitor these elements to effectively navigate and leverage M&A opportunities.

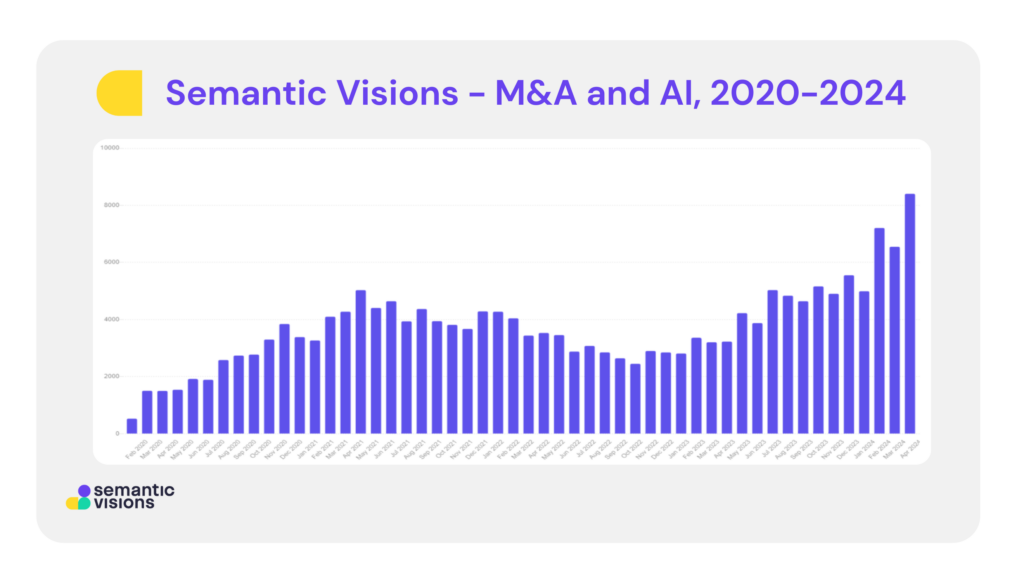

The below chart depicts the media coverage related to AI-related M&A activity between February 2020 and April 2024.

Links to the top stories during this period are included below:

- APR 2021- Microsoft ramps up telemedicine with $19.7 billion purchase of Nuance

- APR 2023- Google merges AI lab into Google DeepMind to compete with OpenAI

- MAR 2024- Apple acquires DarwinAI startup amid generative AI scramble

- DEC 2021- US government sues to block $40 billion Nvidia Arm chip deal

- NOV 2020- Kroger partner buys two U.S. robotic start-ups

Semantic Visions Technology-Driven Value Proposition and Its Contribution to M&A Activity

Semantic Visions is a software-based actionable data analytics and insights company, based in Prague. We have been in the data management business for over 12 years developing, and operating our automated open-source intelligence system that collects and analyzes a substantial part of the global electronic news content.

We operate an outcome-focused AI and ML driven platform to deliver a robust early-detection capability to clients across multiple sectors and industries in support of their risk management, compliance, M&A and opportunity identification decision needs.

The use of our enriched data offerings plays a crucial role in supporting M&A activity at various stages of the process.

- Strategy Development

Our data helps identify market trends, growth opportunities, and competitive landscapes, guiding strategic decisions on potential targets and data analytics can pinpoint companies that align with strategic objectives based on financial performance, market position, and synergies.

- Due Diligence

SV provides clients with enriched data to allow for a more robust and comprehensive financial data analysis to reveal the acquisition target’s financial stability, profitability, and potential liabilities as well as its operational metrics helping the acquiring company to assess efficiency, productivity, and integration feasibility. In addition, the use of our enriched data identifies the acquisition target’s adherence to regulatory requirements, uncovering any potential legal issues or risks.

- Negotiation

Utilizing our enriched data, clients are able to develop data-driven models that simulate various scenarios, aiding in negotiating terms based on potential outcomes.

- Financing

SV enriched data provides our clients the ability to assess risk profiles to determine appropriate financing structures and also determine the acquiring company’s capacity to sustain additional debt without compromising financial stability.

Overall Benefits of SV Enriched Data in M&A

- Risk Mitigation: Data-driven insights reduce the likelihood of unforeseen issues post-transaction.

- Informed Decision-Making: Comprehensive data supports informed, objective decisions throughout the M&A process.

- Efficiency and Speed: Data analytics streamline the due diligence process, allowing for quicker, more efficient transactions.

- Transparency: Data fosters transparency between parties, building trust and facilitating smoother negotiations.

Using SV enriched data effectively in M&A enhances accuracy, reduces risks, and maximizes the potential for a successful integration and realization of strategic goals.

Use Cases

Use Case 1 : U.S. M&A landscape monitoring

Semantic Visions was commissioned to monitor the U.S. M&A landscape, with the view of a potential acquisition.

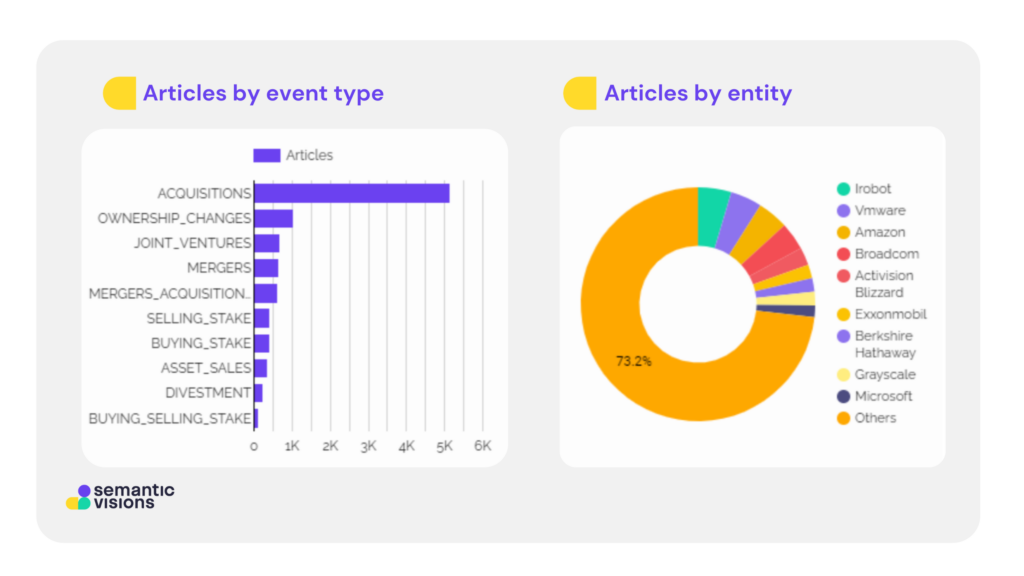

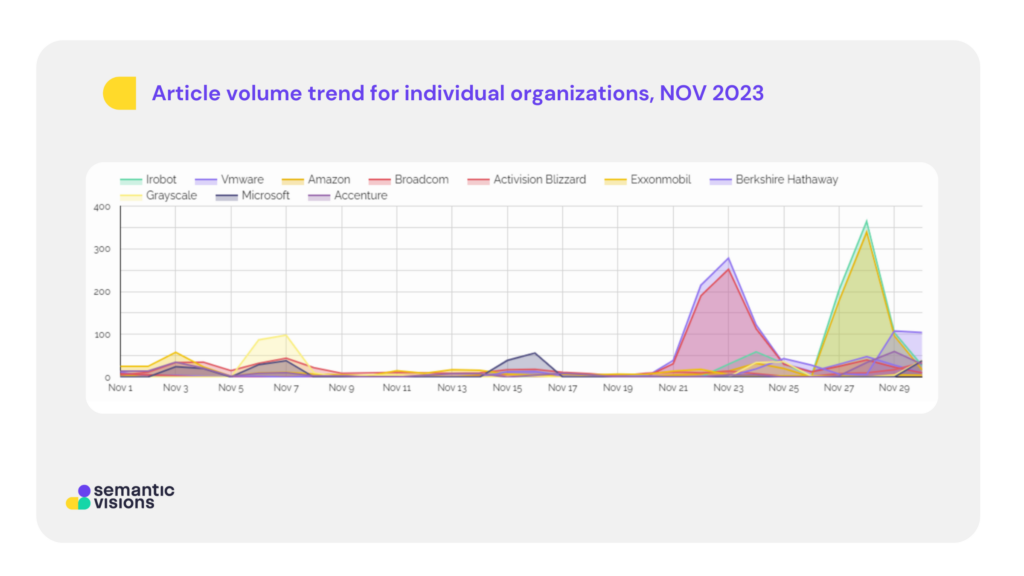

For the month of November 2023, on the basis of media analysis in 12 languages, our system collected and processed over 9 thousand articles, identified 780 business entities and detected 14 event types, see the charts below.

SV presented their client with a comprehensive dashboard covering 28 potential acquisition targets. The material allowed for browsing through over 9,000 articles, checking for the business entities and looking into their involvement in the industry and, moreover, discovering and following the trends on a timeline.

USE CASE 2: Takeover bid- a day in the life of Royal Mail

Royal Mail, founded by king Henry VIII, in operation for over 500 years. Privatized over 20 years ago, the remaining government shares sold in 2015. Currently owned by IDS, with the largest shareholder (27.5%) Vesa Equity Investment owned by EP Group. Fraught with problems of not meeting delivery targets, pay and working conditions disputes, unions demands, profitability, criticism of its services, and its uncertain future.

The key stakeholders are the company employees, the UK government, Ofcom as a regulator, the opposition, trade Unions (CWU) and the shareholders.

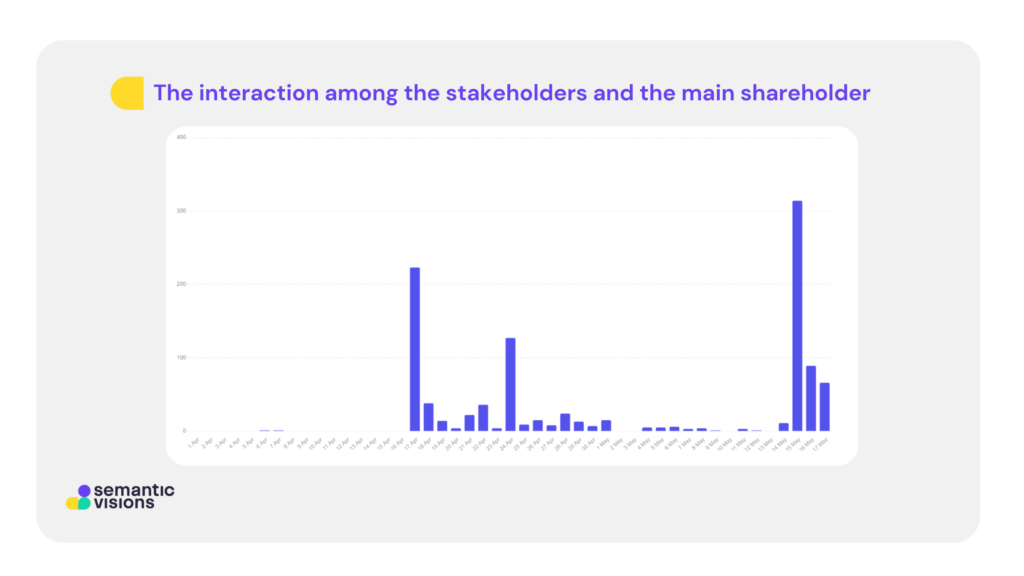

Semantic Visions performed a detailed analysis of the ongoing Royal Mail transformation. The chart below illustrates the interaction among the stakeholders and the main shareholder, represented by D. Kretinsky, between APR 1 and MAY 17, with the peaks explained below.

A timeline of the deal as covered by media: the Headlines

| APR 17 | Royal Mail owner rejects bid approach from Czech billionaire |

| APR 24 | Dave Ward, general secretary of the Communication Workers Union, said the change of ownership to a foreign investor “cannot be right” |

| MAY 15 | Royal Mail ‘minded’ to accept £3.5bn takeover proposal by Czech billionaire |

| MAY 16 | £3.5bn Bid Sends Shockwaves Through UK, IDS indicates inclination to recommend the new offer to investors, following revised proposal of 370p per share |

| MAY 17 | Any bid for Royal Mail would face ‘normal’ security review, says finance minister Hunt |

The complex circumstances of the potential deal involve various stakeholders and numerous, often opposing, interests.

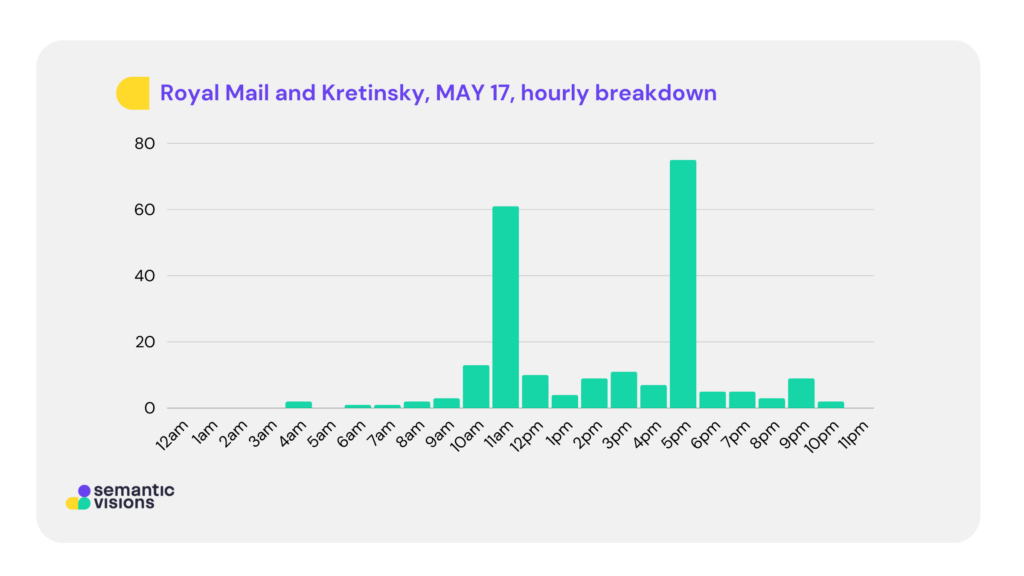

Another SV graph identifies the evolvement of the deal on May 17, 2024, the day Mr Kretinsky tabled the bid for Royal Mail takeover.

| Time | Article Title | Article count |

| May 17 – 10:08 | Czech billionaire Daniel Kretinsky has been exploring a possible bid for the owner of the UK’s Royal Mail | (13 articles) |

| 11:14 | Royal Mail owner rejects bid approach from Czech billionaire | (57 articles) |

| 12:27 | Royal Mail parent soars as takeover by West Ham owner rumored | (7articles) |

| 14:14 | CWU is RIGHTLY skeptical over the news Royal Mail could be facing a takeover bid | (6) |

| 15:26 | IDS shares rise as Czech billionaire posts interest in Royal Mail | (9) |

| 17:55 | Royal Mail owner rejects bid approach from Czech billionaire | (75 articles) |

| 21:18 | Royal Mail investor will struggle to deliver a deal | (8 articles) |

The enriched data analysis delivered by SV generated the following actionable insights: identifying the key stakeholders, mapping of the business circumstances and establishing the positions of the actors, monitoring the evolution of the situation in the long term and short-term period, identifying trends, and detecting relevant events on the hourly basis and in detail.

Use Case 3: Mapping innovation in the oil and gas industry

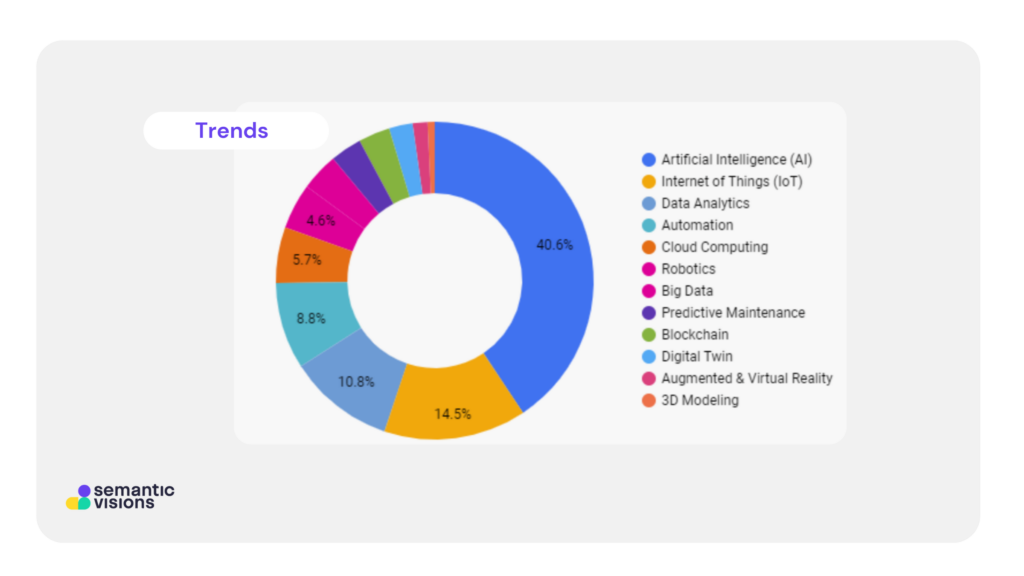

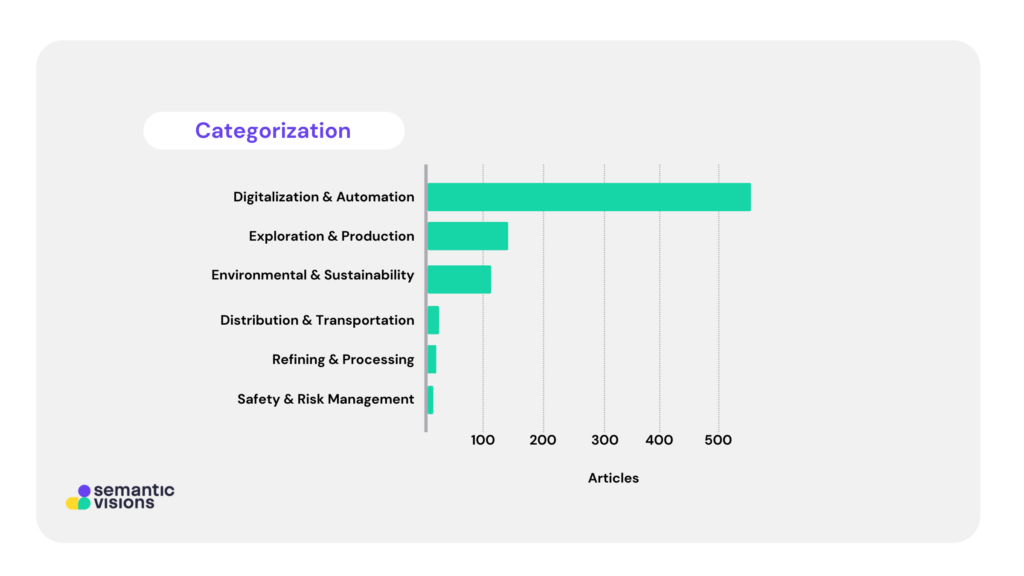

Semantic Visions was commissioned to map and monitor the latest trends in innovation in the oil and gas industry. Our client, a major oil industry company, was interested in clear, structured and up-to-date data that would identify and the latest technological trends used in the industry globally.

Thanks to our automated tracking technology, we collected data for the period DEC 2023 to MAR 2024, collecting 753 relevant articles across 12 languages and detecting 284 relevant entities.

TOP 5 innovation trends:

- AI- 40%

- IoT- 14.5%

- Data analysis- 10.8%

- Automation- 8.8%

- Cloud computing- 5.7%

These trends have been applied in the following main categories: digitization and automation, exploration and production,followed by sustainability and environment. See below.

Our cutting-edge technology provided the client with structured and accessible data that identified the major innovation trends in the oil and gas industry, in addition to categorizing the trends into the various fields of business operations. Besides the key benefits of delivering meaningful insights into the industry trends, the analysis offers an awareness of the market stakeholders and accurate actionable monitoring of major events.

Conclusion

Overall, the M&A market is characterized by its dynamic nature, driven by a combination of economic, industry-specific, regulatory, technological, and governance factors.

As the business landscape continues to evolve, the M&A market will likely experience ongoing changes and adaptations to meet the changing needs and priorities of companies, investors, and other stakeholders.

When planning an M&A deal, businesses must consider multiple aspects to ensure a successful transaction.

As presented above, Semantic Visions’ automated tools provide businesses and organizations with structured data and meaningful insights. By a wide range of methods, SV detects, identifies and structures data that provides actionable intelligence. An elaborate system of event definitions and computational prowess warrant an unmatched analytical instrument to stay informed of events, be they local or global news.