3 min read

Lithium Market Trends: Supply Chain Risks and Growth Opportunities

Global Critical Metals Monitoring: Why is It Crucial?

The global demand for lithium is expected to surge 3.5 times between 2023 and 2030, driven by the electric vehicle (EV) and renewable energy sectors. Lithium is a key component in batteries and energy storage systems, making it vital for the global energy transition. However, this booming demand brings with it several challenges, including a supply glut, price volatility, and financing difficulties for lithium projects.

Lithium Supply and Production Trends

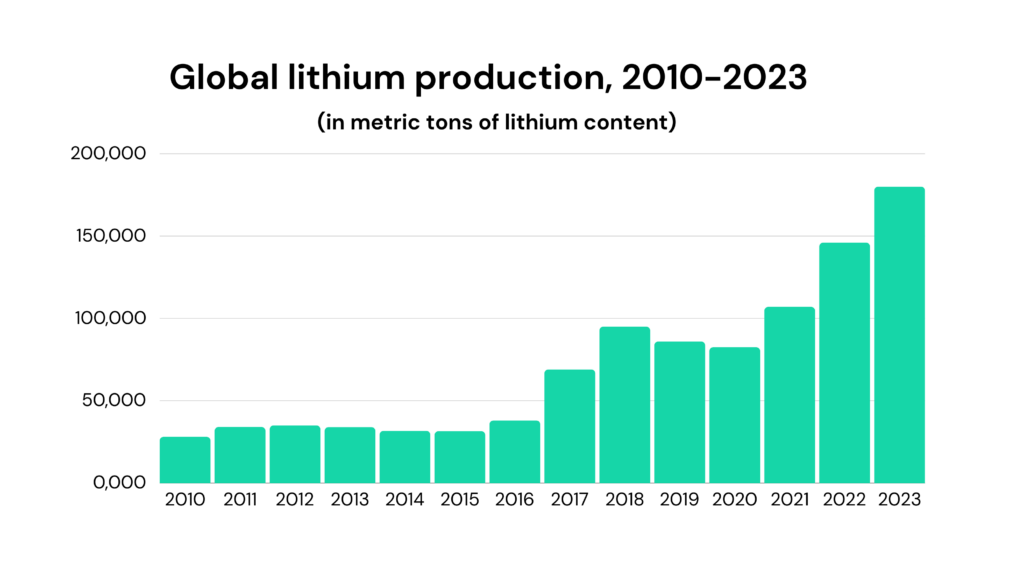

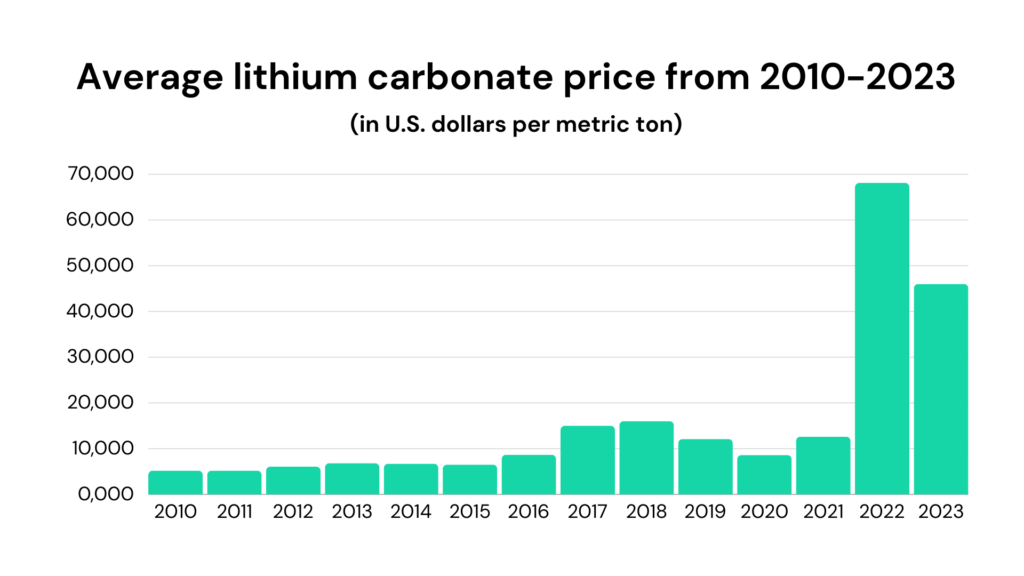

Global lithium production has seen significant growth from 2010 to 2023, as shown in the graph below:

This steady rise in production highlights lithium’s growing importance, but it also underscores the risks associated with fluctuating prices. From 2022 to 2023, lithium carbonate prices saw a sharp decline, creating uncertainties for both producers and investors.

Who Controls the Future of Lithium?

Despite possessing only 11% of the world’s lithium reserves, China controls 60-70% of the global refining capacity, giving it significant influence over the lithium supply chain. This dominance has raised concerns about supply security and geopolitical risks. Countries and industries dependent on lithium are now looking for alternative sources of supply, particularly in emerging regions.

Africa’s Role in the Future of Lithium

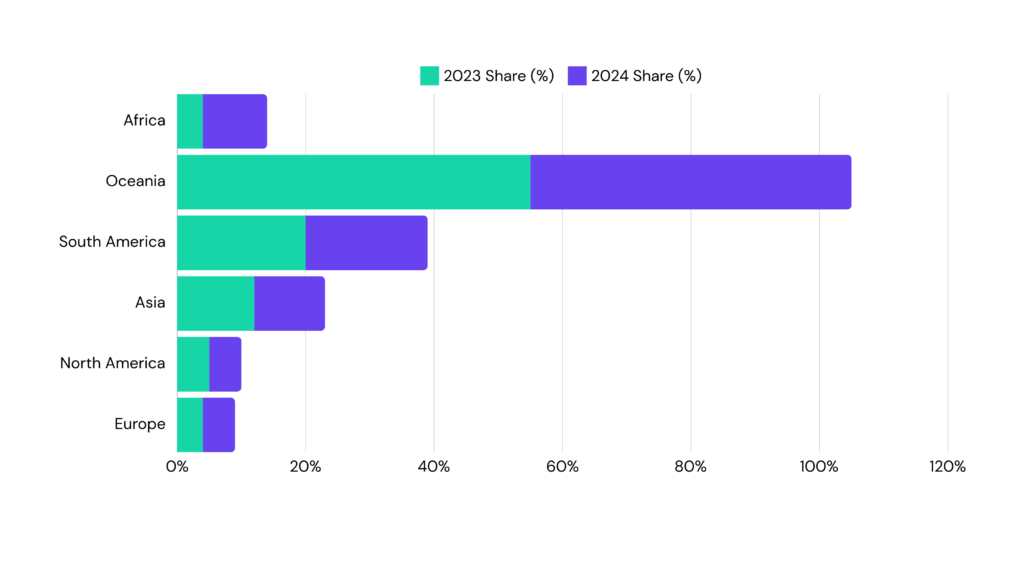

One region that is quickly emerging as a key player in the lithium market is Africa. Africa’s share of global lithium mining is expected to increase from 4% in 2023 to 10% in 2024, positioning it as a fast-growing supplier of this critical metal.

Lithium Supply Chain Risks

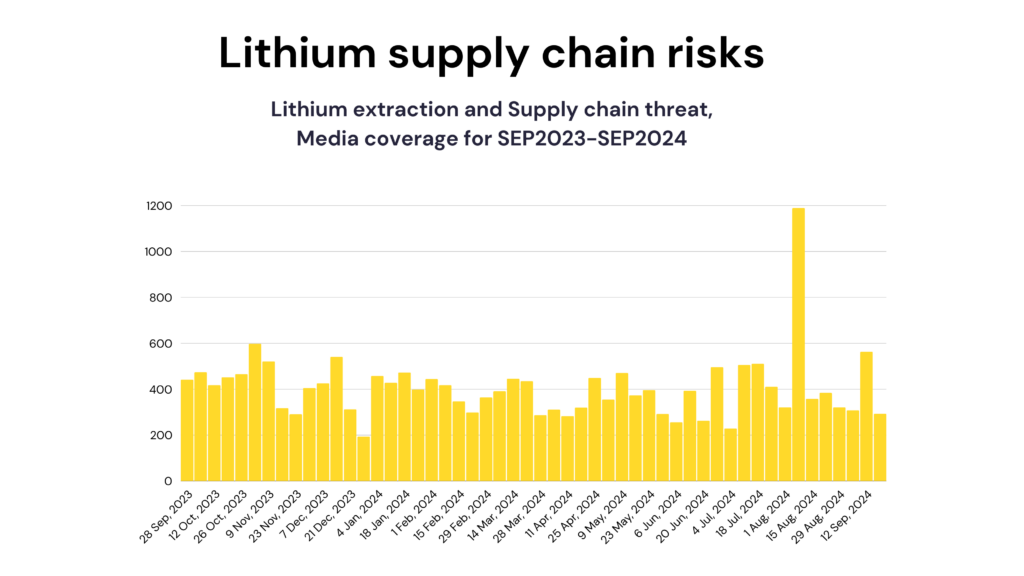

Looking ahead to 2034, the demand for lithium could be 6.5 times greater than in 2023, adding immense pressure on global supply chains. The lithium supply chain faces numerous challenges, including geopolitical risks, export restrictions, and potential nationalization efforts. Furthermore, environmental and indigenous rights conflicts, supply chain vulnerabilities, and political instability are all factors that could disrupt the steady flow of lithium.

Stay Ahead of the Lithium Market with Semantic Visions

At Semantic Visions, we help businesses stay informed about geopolitical developments that could impact the lithium market. Our advanced data monitoring of commodities, such as rare-earth metals, oil, gas, and lithium, ensures that you have the insights needed to navigate this complex landscape.

Connect with us at the Eagle Alpha Conference

Interested in how our data can drive value for your business? Let’s connect at the Eagle Alpha UNBOUND Alternative Data Conference in New York on October 9, 2024. Alternatively, contact us directly for a preview of our commodities dashboard, and we’ll be happy to meet you!