6 min read

Analyzing the 2023 Real Estate Trends – A Global Perspective

In the aftermath of the COVID-19 pandemic, ongoing global conflicts, and supply chain disruptions, the global real estate market has been under scrutiny, with concerns growing about the emergence of a potential bubble. This article, based on Semantic Visions’ screening capabilities, aims to determine the underlying causes and the far-reaching implications for both the real estate market and the broader economy in the past year.

Through its advanced data analytics capabilities, Semantic Visions offers valuable solutions for tracking real estate trends. Leveraging its extensive AI-driven media monitoring tools and sentiment analysis algorithms, we can provide insights into investor behaviour and emerging trends within the sector. Additionally, Semantic Visions’ expertise in utilizing alternative data sources allows for a comprehensive understanding of the factors driving real estate market dynamics, including economic indicators, regulatory changes, and consumer sentiment.

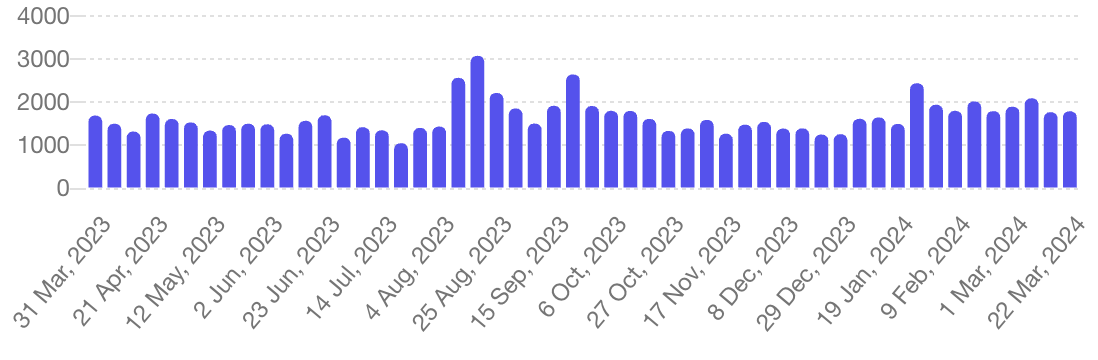

We screened and monitored over 86,727 articles in 12 languages for this article and covered one year of real estate/ banking and investment data.

Insights from Around the World

A large portion of the articles, published in all the covered languages, were linked to the Chinese real estate giant Evergrande, which filed for bankruptcy. This reflects deepening concerns over China’s housing crisis and economic slowdown. With over $300 billion in debt, Evergrande seeks protection against creditors while restructuring its offshore debts totalling $31.7 billion.

- Some of the most published articles in the English language were related to the working households in England that are facing homelessness, with almost 200 households with children in hostels for at least five years, highlighting a deepening housing crisis. Homelessness charities urge the government to raise local housing allowance (LHA) to cover rising private rents, as the latest statistics show the highest number of homeownerships vs. homelessness since records began. Despite government investments, failure to increase LHA rates leaves people with no affordable rental options, worsening the situation.

- The German media often mentions a story from last September highlighting the country’s lack of affordable housing and how two industry groups refused the government’s invitation to a crisis meeting, citing government inaction and burdensome regulations. They criticized the government for ignoring industry demands, including the recently enacted heating law, which they say hampers affordable housing initiatives.

- The media in Spanish largely covers the Council of Europe urging Spain to tackle its severe housing crisis by expediting the Housing Law project and extending the eviction moratorium. The articles highlight a long-standing structural housing issue worsened by decisions allowing private capital firms to invest in housing, leading to soaring rents and a shortage of affordable homes.

- Many articles in Russian report that the local estate market is overheating, with significant price gaps between primary and secondary markets and rising mortgage rates. Experts warn of a potential crisis, fearing loan defaults and even a banking crisis. They highlight the mismatch between property prices and rent, making renting more appealing than buying with a mortgage.

- The reporting in Chinese covers the Deutsche Bank’s preparation to file a lawsuit in Hong Kong seeking to liquidate China’s real estate developer Shimao Group. This action comes amidst deepening crises in China’s real estate industry, with more developers facing debt defaults. Another story that is largely reported is linked to how Shanxi Stock, the China-based security company principally engaged in commodity trading and risk management businesses, plans to exit the real estate sector by publicly transferring its real estate assets. This decision follows a history of financial challenges, including bankruptcy restructuring. Despite initial obstacles, the company aims to divest its real estate holdings.

- The Japanese-language media also focused on Evergrande and its avoidance of immediate default by paying off USD bond interest. It is mentioned that the company faces a long road to recovery due to massive debts and a slow real estate market. The company extended the maturity of domestic bonds, but it still needs to repay billions by June 2024. Despite the Chinese government’s efforts to stabilize the market, Evergrande’s heavy reliance on smaller city projects and declining sales led to a significant loss in the first half of 2023 and cash flow issues.

- In Arabic, it is largely reported that Prime Minister Mustafa Madbouly oversaw the signing of Egypt’s largest direct investment deal with the UAE’s Abu Dhabi Development Holding Company. The agreement aims to develop Ras El Hikma city on the northwest coast, aligning with Egypt’s efforts to attract foreign investment.

- In the Czech media, one of the most published pieces is an analysis focusing on housing issues that suggests that Prague has the least accessible housing in Europe, and that private construction alone will not solve the problem. Despite measures taken by the Prague City Hall in recent years, the situation has worsened significantly, with proposed solutions including increased municipal construction, rent regulation, or progressive taxation of investment properties.

- The media in French suggests that in 2023 many real estate professionals were displeased with the government’s housing plan, seeing it as inadequate for the sector’s crisis. Unlike previous strategies that relied on fiscal measures to boost the market, the latest plan eliminated tax breaks and reduced interest-free loans, signalling a shift away from public funding. While this move was considered bold, it has come at a challenging time, as the sector faced falling purchasing power due to rising interest rates.

- The Portuguese-language articles covered the retail real estate market in Brazil since hundreds of stores shut down due to economic challenges from the pandemic, inflation, and declining income. Dia led the closures with 343, followed by Americanas with 159. Carrefour, Marisa, and Casas Bahia are also reducing their physical presence.

- The media coverage in Italian mentioned that students across the country are protesting high rents by camping outside universities. They demand government action to address the housing crisis. The educational ministry promises a census of unused properties for student housing. Political controversy arises as government officials and local authorities exchange accusations regarding the issue.

- The Korean media was focused on the growing financial crisis in the real estate sector, particularly on the issue of non-performing real estate project financing (PF). Highlighting the case of Taeyoung Construction, which recently entered into joint management procedures due to its inability to repay a significant real estate PF loan, the coverage reflects broader concerns about the escalating levels of non-performing PF loans in the construction industry.

Analyzing media coverage in various languages, from the Evergrande crisis in English to affordability concerns in Prague, Semantic Visions offers insights into market dynamics. We empower clients to navigate the complexities of the real estate market with confidence and agility, helping them stay ahead of the curve and capitalize on emerging opportunities while mitigating potential risks. Don’t hesitate to contact us for more information and data samples.